AllianzIM ETF Resource Library

See how Exchange-Traded Funds (ETFs) with a buffer or a floor can offer risk management in a portfolio.

New to Buffered ETFs? Watch this 5-minute video.

Recorded Webinars

Downloadable Resources

Buffered ETF Investor Guide

Buffered ETF Implementation Guide

Deconstructing Buffered ETFs

Cushion Market Drops with Buffered ETFs

Defending Your Portfolio With a 5% Floor ETF

Reaching for Higher Returns with Buffer15 Uncapped ETFs

SPBU: A Full Portfolio of Buffer15 Uncapped ETFs in One Ticker

SPBW: A Full Portfolio of Buffer20 ETFs in One Ticker

SPBX: A Full Portfolio of 6 Month Buffer10 ETFs in One Ticker

Laddering Benefits of Buffer Allocation ETFs

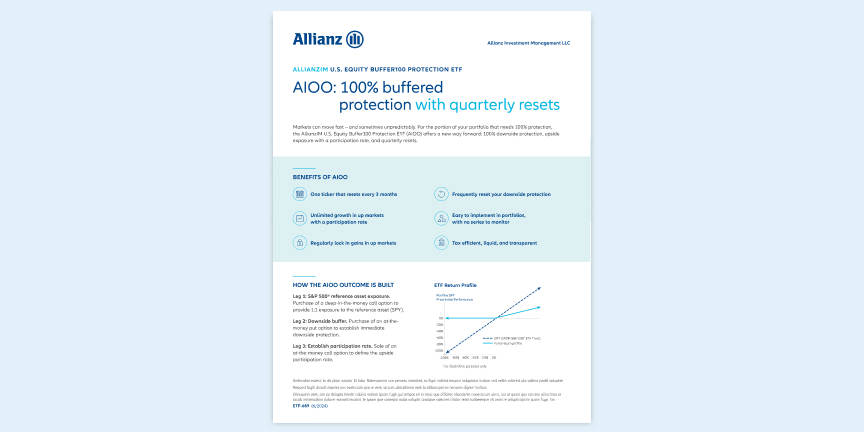

AIOO: 100% buffered protection with quarterly resets

QBSF: A quarterly buffered ETF with 15% downside protection

Ready to make a trade?

Get to know our products

Designed to bring in-house hedging capabilities and a track record of managing risk to the retail investor.Contact us

We will walk you through it.Allianz Investment Management LLC (AllianzIM), a wholly owned subsidiary of Allianz Life Insurance Company of North America, is a registered investment adviser and adviser to AllianzIM ETFs.

Investment involves risk, including possible loss of principal. There is no guarantee the funds will achieve their investment objectives and may not be suitable for all investors.

Investors may lose their entire investment, regardless of when they purchase shares, and even if they hold shares for an entire Outcome Period. Full extent of caps, buffers, floors, participation rates and spread only apply if held for stated Outcome Period and are not guaranteed. The cap participation rate, and spread may increase or decrease and may vary significantly after the end of the Outcome Period.

An investor who purchases fund shares after the Outcome Period has begun or sells Fund Shares prior to the end of the Outcome Period may experience results that are very different from the investment objective sought by the fund for that Outcome Period. There is no guarantee that the cap, participation rate, or spread will remain the same after the end of the Outcome Period.

The spread cost represents the upside performance a shareholder forgoes in return for the downside protection provided by the buffer. Any upside performance as measured at the end of the outcome period will be reduced by the spread cost and management fee. The fund's performance will not reflect the entirety of any upside performance of the reference asset.

There is no guarantee that the outcomes sought for an Outcome Period will be realized, and there is no guarantee that the buffer will limit fund losses or that participation in the underlying ETF's positive returns subject to the participation rate will be achieved. The outcomes that the fund seeks to provide do not include the costs associated with purchasing shares of the fund or the fund's annualized management fee. The participation rate and buffer will be further reduced by brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses not included in the fund's unitary management fee. To achieve the target outcomes sought by the fund for an Outcome Period, an investor must hold shares for that entire Outcome Period. The participation rate and buffer will be further reduced by brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses not included in the fund's unitary management fee.

The buffered outcome and floor ETFs' investment strategies are different from more typical investment products, and the funds may be unsuitable for some investors. It is important that investors understand the investment strategy before making an investment. For more information regarding whether an investment in the funds is right for you, please see the prospectus including "Investor Considerations."

Unlike the underlying ETFs, the buffer allocation funds do not pursue a buffered strategy. The buffer is only provided by the underlying ETFs and the buffer allocation funds themselves do not provide any stated buffer against losses. The buffer allocation funds will not receive the full benefit of the underlying ETFs’ buffers. The buffer allocation funds could have limited upside potential, and their return may be limited to the caps of the underlying ETFs. The underlying buffered outcome ETFs investment strategies are different from more typical investment products, and the funds may be unsuitable for some investors. It is important that investors understand the investment strategy before making an investment.

Investing involves risk including possible loss of principal. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. For a prospectus with this and other information about the Fund, please call 877.429.3837 or review the prospectus. Read the prospectus carefully before investing.

Distributed by Foreside Fund Services, LLC. Allianz Investment Management LLC and Allianz Life Insurance Company of North America are not affiliated with Foreside Fund Services, LLC.

Please note: We use cookies to make your online experience more convenient. For more information view our Privacy Policy.

Privacy Overview

Need help placing a trade? Questions about portfolio construction? We’re here to help.

Find your dedicated ETF Specialist

-

Select your state or territory

-

ETF specialists closest to you

AllianzIM ETFs are available through your investment professional or online brokerage account.